Onboarding project | Porter.in

WHO is signing up

Ideal Customer Profile

Product Pitch

Porter is a goods transport agency catering to on-demand, intra-city goods movement. Through technology, Porter connects a highly fragmented largely SME customer base with a highly fragmented largely driver-cum-owner partner base.

- Demand side user : Customers

- Supply side user : Driver Partners

We will focus on the demand side user i.e. the customer for the rest of the analysis.

Understand the customer and the product

Porter is in the business of providing on-demand, intracity goods transport for small and medium enterprises (SMEs).

Porter is present in 20 cities in India and 2 international countries (UAE, Bangladesh).

Porter has goods vehicles ranging from 2w all the way to 14ft trucks.

Top Customer Pain Points | Porter Feature | Outcome using Porter |

|---|---|---|

Vehicle not available when needed | Digital matchmaking with a | Allocation of vehicle within 5 minutes. |

Cost is high. | Low prices due to high utilization. | 15-20% lower cost per trip. |

Need to negotiate with driver. | Fixed price, well defined service. | No negotiation with driver partner. |

Need to call and check where | Digital tracking. | Real time knowledge of exact location of |

Need invoice for records and filings. | Consignment note. | 100% compliance through automatically |

Pay more due to required vehicle | Select from range of vehicles from | Pay only for most efficient and effective vehicle. |

e-commerce, quick commerce | Digital logistics features expected | Compete by providing similar digital features to |

Core value proposition

For a tech savvy SME who needs a reliable yet affordable way to transport goods on demand, Porter is a goods transport agency that provides transparent, cost-effective goods transport pickup within 15 minutes.

Brand wedge

If industry perception is that only a known driver will pickup and deliver goods reliably, and SME customers feel that they do not know how to get vehicle on time to move their goods, Porter will always prioritize building trust with the customer by ensuring that goods are always immediately transparently transported.

Positioning against competition

Competition | Strength | Weakness | Porter Positioning |

|---|---|---|---|

Unorganized sector | Familiarity of person, pickup and | Uncomfortable price negotiations. | Vehicle always available. |

Uncle Delivery | Lowe price. | Poor fulfilment. | Vehicle always available. |

Traditional Packers and | Packaging. | High price for short distance. | Value for money price with |

User insights

Ideal customer profiles formulated through insights

Parameter | Small SME | Medium SME | Retail | Enterprise | Specialty |

|---|---|---|---|---|---|

Industry | Furniture, Textiles, | Chemicals, Cement | Personal use | Automobile | Milk, Newspaper, |

Age | 20 - 40 years | 30 years - 50 years | 15 - 40 years | 30 - 45 years | 20 - 40 years |

Gender | Male | Male | Female / Male | Female / Male | Male |

Location | Market area | Market area | Residential | Outskirts, | Mixed |

Turnover | < 25 crore | 25 to 250 crore | Annual Salary | 250 crore+ | 25 to 250 crore |

Apps | WhatsApp, Facebook, | WhatsApp, Facebook, | WhatsApp, Facebook, Uber, Ola, Maps | SAP, Oracle, MS Office, | WhatsApp, Facebook, |

Most Value | Cost | Availability | Convenience | Availability, Invoices | Vehicle load body |

Frequency of use | 2 - 25 times a day | 25 - 100 times a day | 2-5 times a week | 100+ times a day | 25 - 100 times a day |

Key features | Price, tracking | Near real time allocation | Mobile app | Consolidated invoice | NA |

Decision maker | Same | Mix of same and different | Same | Different | Mix of same and |

Willing to spend | For 3w, 400 per trip | For 3w, 450 per trip | For 3w, 500 per trip | For 3w, 400 per trip | For 3w, 450 per trip |

ICP prioritization

Nuances

- For customers without vehicle, the need is for all goods moment whereas for customers with a vehicle (own or captive through long term contract), the need is for peak management which spills over and above planned.

- While individually, ability to pay of small SME may be low compared to medium SME, collectively they make it up through volume.

- For the TAM evaluation, present or near future product capability is considered. This means that while for enterprises, TAM could potentially be very high, it is low in our case due to their use case (credit period, APIs etc.) not being addressed by the product.

- In some cases, the decision maker on which logistics service provider to be used, and the operational executor are not the same person. In such cases, one of the two parties could potentially be influencers or turn out to be blockers.

Prioritization

ICP | Priority | Adoption Pace | Use Case Frequency | Appetite to Pay | TAM | Distribution Potential |

|---|---|---|---|---|---|---|

Small SME | 1 | Medium | High | Low | High | Medium |

Medium SME | 2 | High | Medium | Medium | Medium | High |

Retail | 3 | High | Low | High | Medium | High |

Enterprise | 4 | Low | High | High | Low | Low |

Specialty SMEs | 5 | Medium | Medium | Low | Low | Low |

Why not the other ICPs?

- Medium SME with vehicle: While they are usually more tech savvy and have higher budgets, they also typically have a set arrangement, if not their own vehicle. They will use Porter only for the peaks.

- Retail: While they are tech forward and more convenience seeking, the use case is limited mostly to 2w service and does not cover majority of the core services (trucks) offered by Porter. It is a valid ICP to pursue specifically for the 2w line of business but not at company level.

- Enterprise: While they have high budgets and high frequency of usage, they have long term contracts with fixed providers.

- Specialty SMEs: While the frequency is high, they need specialized vehicles that are not available on the platform.

Selected ICP: Small SME without vehicle

Selected ICP deep dive

Dimension | Value | Reasoning |

|---|---|---|

Adoption Pace | Medium | While small SMEs are not very tech savvy, they still use |

Frequency | High | They do not have own vehicle and cannot afford to |

Appetite to Pay | Low | They are always stretched for working capital. |

TAM | High | The unorganized sector is very significant with millions |

Distribution | Medium | While not very tech savvy, they are still reachable |

WHAT are they trying to do

Customer Journey Map

Customer persona: Small SME without vehicle.

Goal of the map: Onboarding and activation.

Overall perspective:

Porter app experience focused perspective:

WHY are they signing up

Jobs To Be Done (JTBD) and Validation

Goal Type | ICP 1 | ICP 2 | ICP 3 | ICP 4 | ICP 5 |

|---|---|---|---|---|---|

Personal | NA | NA | NA | NA | NA |

Social | NA | NA | NA | NA | NA |

Financial | Primary: I need low cost | NA | NA | NA | Secondary: I low operational cost |

Functional | Secondary: I need to get reliably. | Primary: I need to manage | Primary: I need to get my | Primary: I need highly reliable | Primary: My goods need specialized |

Small SME without vehicle (selected ICP) deep dive

Why is the JTBD primarily financial and not functional?

- There is high pressure on margins due to low bargaining power and competition from big online and offline players.

- It is relatively manageable if there is some delay in ETA etc. since there is not much scheduled upstream or downstream activities lined up (as opposed to Enterprise of Medium SMEs).

- Functional goal is still important because the goods still need to be reliably delivered. The small SME cannot afford pilferage or other issues. Also, they do not have the clout to get good service from unorganized player and hence, getting vehicle from Porter is an important functional need.

Validation of the financial and functional JTBD through "what keeps him awake at night" customer insights

Aha Moments

Moment 1: Transparent options

For selected pickup and drop locations, immediately, the cost and ETA of different vehicles is displayed. This is quite a contrast to the competition (unorganized sector) where

- Multiple calls need to be made to get vehicle availability.

- Price finalization is a painful negotiation.

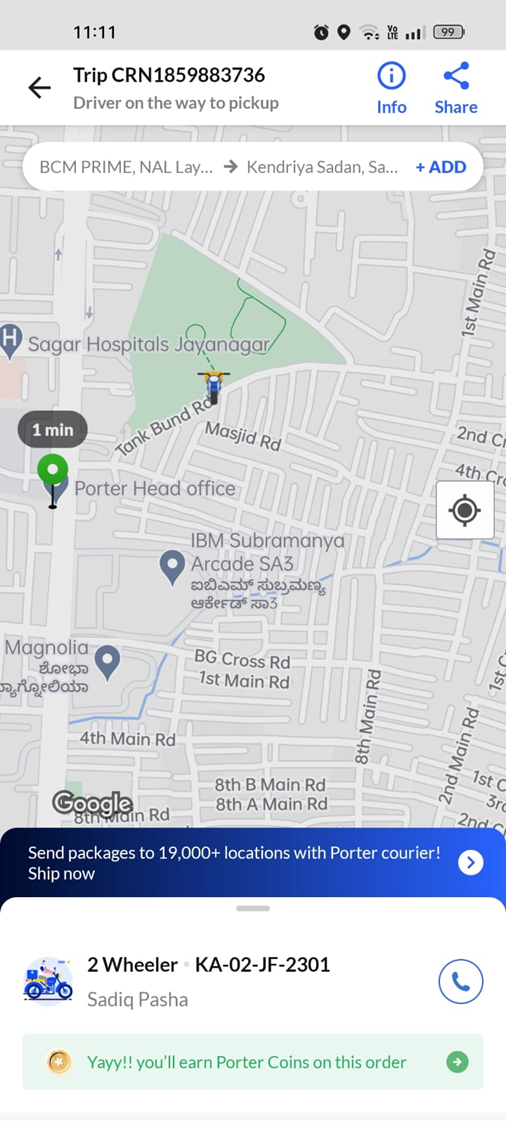

Moment 2: Tracking of vehicle

As soon as the trip is accepted by a driver partner. There is clear tracking on the map all the way till goods are picked up and subsequently dropped.

This is quite a contrast to the competition (unorganized sector) where

- Multiple calls need to be made to see when pick up will happen.

- Post pick up, multiple calls need to be made to see where the vehicle is and when drop will happen.

Moment 3: Rebooking without entering details

There is no need to select pick up and drop locations again. Directly, the details can be reviewed and booking can be made.

Onboarding Teardown

Porter Customer Onboarding Teardown.pdf

Android app teardown summary (Refer to above pdf for screen by screen)

App discovery

Installation

Account creation

First order and largely subsequent orders

Support

Website teardown summary (Refer to above pdf for screen by screen)

Discovery

Website Flow

Help

Activation Metrics

Activation metric 1

Hypothesis: 3 orders in 1 week

Reasoning:

Why orders:

- Every time a customer does an order, they experience the aha moments around clarity of price and eta, tracking.

- On every order, they experience the core value proposition of transparent, 15% to 20% lower cost goods transport pickup within 15 minutes.

Why three orders:

- Once they experience the core value proposition 3 times, they internalize and associate Porter with consistent value for money, hassle free service and will then continue using Porter due to habit formation.

- Using Porter 3 times would also provide the experience at different times of the day and potentially different vehicle categories within Porter, leading to more confidence building.

Why 1 week:

- It is important to experience the core value 3 times within a week so that the augmentation of experience happens. If it is over a longer duration, there may be lack of connecting the dots back to earlier experience.

- Given that a customer may be placing ~10 orders a week, there may also be opportunity for the competition to win back the customer if they do not do at least 3 trips with Porter.

Activation metric 2

Hypothesis: 2 five star rated orders in 1 week

Reasoning:

Why five star rated orders:

- A 5 star rating implies that the customer had a delightful experience. There was no part of the journey where they felt dissatisfied.

Why two star rated orders:

- Two 5 star ratings showcase that the customer has experienced the core value prop multiple times with a delightful experience.

- Two ratings also ensures that customers are assured of consistent experience across multiple driver-partners.

- Since it is a pattern, habit will get formed and customer will continue to use Porter.

Why one week:

- A customer typically does ~10 orders a week. To rate Porter order twice, they need to do at least 3 orders (assumption of 66% conversion of order complete to rating). This ensures that they have experienced the product sufficient times so that consistently across time, across vehicle categories, they have experienced the core value proposition.

It is important to get 2 five star rated orders within a week so that the augmentation of experience happens. If it is over a longer duration, there may be lack of connecting the dots back to earlier experience.

Activation metric 3

Hypothesis: 3 orders using the "book again" feature in 1 month

Reasoning

Why booking using "book again" feature:

- Booking using the book again feature further makes it almost an "one click" type of experience where there is no need to enter pick-up and drop-location, the vehicle category is already selected. Using this feature provides and additional level of delight.

- If a customer is using "book again", it is a fair signal that for that particular trip (pick up, drop, vehicle category), they recall that had used Porter earlier and had a good experience.

Why 3 orders booking using "book again" feature:

- Using the "book again" feature 3 times results in augmentation of good experience by going through the core value proposition multiple times.

- Since it is a pattern, habit will get formed and customer will continue to use Porter.

Why 1 month:

- Since there may be need for multiple pick up and drop locations, the need to repeat same combination may arise only 4-5 times in a month.

Activation metric 4

Hypothesis: 5 referrals in 1 month

Reasoning:

Why referrals:

- When a customer refers, they are putting their social credibility on the line.

- A customer will only refer if they are convinced by the product and see a significant improvement over the competition.

- Referrals provide social proof.

Why five referrals:

- One or two referrals may be done for the monetary incentive.

- Five referrals would cover a significant social circle and hence, it is a higher risk that customer is taking, which can be taken as strong endorsement.

Why 1 month:

- Since referrals involve personal credibility, customer will only refer 5 times after they have experienced the core value prop multiple times and have become a regular user.

Activation metric 5

Hypothesis: Use of at-least 2 categories of vehicles in 1 month

Reasoning:

Why usage of multiple categories:

- When a customer uses multiple categories, they experience a further delight that they can now chose the vehicle fit for purpose and only pay for the most efficient way of transporting their goods.

- Further, the customer can, at one place, get access to the right vehicle for right circumstances such as a two wheeler or three wheeler for congested places, closed body truck when it looks rainy etc.

Why two categories:

- The categories are structured in such a way that there can be a use case serviced by possibly the adjacent categories by considering factors such as over sizing and over loading.

2w: 20 kg, 3w: 500 kg, Ace: 750 kg, Pickup 8ft: 1250 kg - Using two categories provides sufficient validation and captures majority of the needs of the customer such that they do not need to go outside for any other needs. This is reflected in wallet share.

Why 1 month:

- Occasion to use multiple categories of vehicles may only arise 2-3 times in a month.

- Using Porter for at-least one such time in a month indicates the habit formation and trust.

Metrics to track

North star: M12 retention

L0 metrics | L1 metrics |

|---|---|

New user acquired | |

Play store page visited | |

| App installed |

| App opened |

Account creation completed | |

P90, Average time taken to create account | |

First order placed | |

P90, Average time taken to place first order | |

Orders | |

Sessions | |

"Review Booking" (Price and ETA check) | |

Orders placed | |

| Customer cancellations |

Driver cancellations | |

System cancellations | |

D30 retention | |

Sessions on sign-up page | |

Account creation completed | |

First order placed | |

| DAU |

MAU | |

DAU / MAU | |

D1 retention | |

| D7 retention |

D14 retention | |

Order Ratings | |

Orders completed | |

Rating nudge sent | |

Rating page opened | |

Rating completed | |

Referrals | |

Referral page visited | |

| Referral shared on WhatsApp |

App rating | |

| App rating nudge sent |

Rating done | |

| Rating distribution |

NPS | |

NPS |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.